Keep up to date with all things caravanning

Finding the Best Caravan Insurance in Australia

October 18, 2023

When choosing caravan insurance, there are many things to consider, from how you plan on using the caravan, to premium costs, contents cover and replacement value, to name a few. To help you decide on the best current Australian caravan insurance, we will guide you through the types of caravan insurance, coverage, cost, and what to look out for when choosing a policy.

Based on our quotations, the most competitive insurance options came from RACV, Over 50 Insurance & Let’s Go Caravanning. Finding the best caravan insurance will depend on your individual needs such as budget, caravan type and age, the age of the driver/s and the contents you need coverage for.*

Why is Caravan Insurance Necessary?

Caravan insurance not only protects your caravan and contents but also provides cover in case you damage someone else’s property. Purchasing a caravan is an investment worth protecting, particularly considering the amount of time spent on the road, which increases the risks of accidents or unforeseen damage. Without insurance, you may have to spend your money on repairs or damage to another person’s property should an accident occur. Caravan insurance can cover everything from accidents to storms (including hail and floods), accidental or malicious damage, fire, and emergency repairs.

How Much Does Caravan Insurance Cost?

Annual caravan insurance in Australia can range from a $500 premium to over $3000 depending on the provider, the type and level of coverage you choose, the sum insured, and the excess. The table below is arranged in premium price from the lowest to highest and includes content cover, legal liability (cover if you are found liable to pay compensation to someone else’s property), if a replacement caravan is provided, online claims and basic excess.*

| Insurance Provider |

Content Cover Maximum |

Legal Liability |

Replacement Caravan |

Online Claims |

Annual/Monthly Premium |

Excess |

| RACV | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1110.69

(M)$95.47 |

$500 |

| APIA | Purchase separately | $20 million | New caravan if less than 2 years old | Yes | (A)$1110.93

(M)$92.57 |

$300 |

| Over 50 Insurance | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1298.07

(M)$108.17 |

$200 |

| Club 4X4 | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1299.14

(M)$112.39 |

$500 |

| NRMA | $1000 | $20 million | New caravan if less than 2 years old | No | (A)$1467.35

(M)$125.19 |

$200 |

| Youi | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1474.12

(M)$136.49 |

$1250 |

| Let’s Go Caravanning

(Standard) |

$2000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1650.03

(M)$153.31 |

$500 |

| CIL | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$1810.15

(M)$150.84 |

$300 |

| CGU | $500 | $30 million | Less than a year old and total loss, will replace it | No | (A)$1902.43

(M)$158.53 |

$800 |

| Let’s Go Caravanning (Prestige) | $5000 | $20 million | New caravan if less than 3 years old | Yes | (A)$2019.70

(M)$187.66 |

$500 |

| AAMI | $1000 | $20 million | New caravan if less than 2 years old | Yes | (A)$2321.26

(M)$232.12 |

$300 |

| Suncorp | $1000 | $ 20 million | New caravan if less than 2 years old | Yes | (A)$3069.62

(M)$306.96 |

$300 |

*We obtained a range of quotes during September 2023 and have done our best to obtain the most relevant details at this time for one of our vans.* While our information is accurate as per September 2023, this is a high-level comparison overview only. Please note that we will not be regularly updating this article, so inclusions and prices are subject to change. This information is not to be solely relied upon, or taken as financial advice. Always read the product disclosure statement and consider if the product makes sense based on your financial circumstances. We suggest you contact insurance providers directly, or discuss your needs with a personal consultant as required. While we’ve rated who we think were the most competitive for our needs, we do not rate caravan insurance policies and make no recommendation about features and benefits of these policies. *These quotes were for our demo touring caravan, 21ft, no annex, no extras, no off-road, stored in the garage when static. Agreed value is $80,000.

Types of Caravan Insurance

Caravan insurance covers caravans and camper trailers as they are non-motorised vehicles towed by a car. As a rule, there are three different types of caravan insurance policies available, whether you are hitting the road or staying in one place. It’s important to determine the appropriate category to have the correct cover for a given situation and to ensure any claims are approved.

Caravan insurance covers:

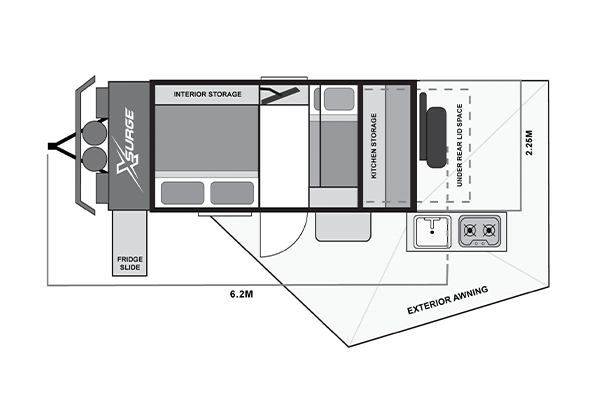

- Touring Caravan. This insurance provides cover for caravans that are towed behind another vehicle. When you are out on the road, touring caravan insurance is the right cover for protection over everything from the structure of the caravan to the contents.

- Static Caravan. This applies to a caravan parked permanently and kept in a fixed location, like a caravan park or a private property. If you have a caravan that will not be moved, then static caravan insurance is a good choice. It will cover you for accidental damage, natural incidents like storms and fires, and vandalism.

- Camper Trailer/Folding Camper. This type of insurance applies to camper trailers, pop-out campers, and fold-out campers. While it provides similar cover to caravan insurance, it doesn’t include content or weather damage protection due to the less sturdy structure.

Caravan insurance does not cover:

- Motorhome. A motorhome is an engine-powered vehicle not classed in the caravan category. It has its own insurance policies that are separate from a caravan. As it is a powered vehicle, it is similar to car insurance with levels like comprehensive and third-party available. A motorhome must also have mandatory CTP ‘Green Slip’ insurance (an insurance policy that protects the driver of the motor vehicle from liability where they cause injury or death in a motor accident).

The Three Levels of Caravan Insurance Cover

Much like motor vehicles, there are different levels of insurance for caravans. It is important to know the levels of coverage and what they offer to decide which is best for you. The three levels of caravan insurance are:

- Comprehensive. This is the highest level of cover and includes cover for accidents, theft, damages to someone else’s property, most severe weather events, fires, and accidental damage to your caravan or trailer.

- Third-Party Fire & Theft. This covers you for damage to another person’s property, plus damage to your caravan from fire or theft. Unlike comprehensive, it does not cover any damage caused to your caravan during an accident or weather event.

- Third-Party Property Only. This is the basic cover and only provides cover for damage done to someone else’s property.

General Inclusions with Each Cover Level

Comprehensive Caravan Insurance

| Situation | Cover |

| Accidental Damage | Cover for damage caused by accident eg road accident |

| Intentional Damage | Cover for damage that is caused intentionally eg theft or vandalism |

| Towing Cost | Cover for reasonable towing and storage of caravan to nearest place |

| Keys and Locks | Up to $1000 for replacing and recoding stolen keys |

| Clean Up After Accident | Up to $1000 cover for accident clean up |

| Emergency Accommodation | If you are more than 100 km from home and cannot stay in a caravan, up to $1000 for accommodation |

| Theft | Cover for damage that is caused by theft of the caravan (not contents inside) |

| Contents | Cover up to $1000 which can be increased with policy upgrade. Some providers already include up to $5000 contents cover in their comprehensive policies. To cover valuable possessions inside the caravan, it is advisable to specify personal valuables on your policy. |

| Counselling Fees | Up to $1500 per person for counselling post-event |

| Food Spoilage | Cover up to $500 for spoiled food |

| Caravan Park Fees | Cover up to $1000 for park cancellation/rebooking |

| Fire/Earthquake | Cover to damage caused by fire/earthquake |

| Legal Liability | Cover up to $ 20 million for damage to another’s property |

*This is a guide only and will vary depending on the provider.

Third Party Fire & Theft

| Situation | Cover |

| Towing cost | Cover for reasonable towing and storage of caravan to nearest place |

| Emergency Accommodation | Up to $1000 cover if you are more than 100km from home and cannot stay in caravan |

| Counselling Fees | Up to $1500 counselling per person post-event |

| Theft | Cover to damage caused by the |

| Contents | Up to $1000 cover which can be increased with policy upgrade |

| Caravan Park Fees | Cover up to $1000 for rebooking/cancellation |

| Fire/Earthquake | Cover to damage caused by fire/earthquake |

| Legal Liability | Up to $20 million for damage to another’s property |

Third Party Property Only

| Situation | Cover |

| Counselling Fees | Up to $1500 counselling per person post-event |

| Legal Liability | Up to $20 million for damage to another’s property |

*It is important to note that most insurance policies do not cover roadside assistance for cars and caravans in the event of a breakdown. To obtain roadside assistance, you must contact the insurance provider to see if it is offered as an optional extra, or contact an external roadside assistance provider for coverage. When organising roadside assistance, specify the policy needs to cover a car towing a caravan. Roadside assistance is invaluable if the car breaks down, as the caravan will be covered for towing rather than simply left at the side of the road. If a driver falls ill and is unable to drive, the car and caravan will be transported for the customer with a roadside assistance policy.

What Does Caravan Insurance Not Cover?

As you can see, exactly what insurance will cover depends on your chosen policy. However, there are some common exclusions that no insurance policy will cover. These include:

- Lack of maintenance

- Pre-existing damage

- Wear and tear of the caravan, deterioration, rust, mould, corrosion

- Faulty design or mechanical/structural failure of the caravan

- Electric motors

- Water leaking from shower

- Towing caravan with an unroadworthy vehicle

- Unlicensed driving

- Using caravan for illegal purposes

- Vermin

- Act of war or terrorism

Caravan Insurance Excesses

An insurance excess is the amount you pay if you claim on your insurance policy. Basically, it is your agreed contribution towards the claim, with the amount being dependent on the circumstances and the incident you are claiming for. Caravan insurance excess is calculated by considering anything from a driver’s age to driving history. The most common caravan insurance excesses to look out for are listed here.

- Basic. This is the basic excess you pay regardless of the claim. The amount is selected and agreed upon when you sign the policy. It can be increased or decreased if you want to make your monthly payments higher or lower.

- Age Excess (16-20 year olds) & (21-24 year olds). The amount you have to pay if the driver was under the age of 24 at the time of loss or damage. The excess for a 16-20-year-old is approximately $500, and $300 for a 21-24-year-old.

- Transportation Excess. This excess will apply if your caravan needs to be transported by sea, rail, or road and excludes general towing.

- Off Road Excess. This $200 excess applies when the caravan has been driven off-road.

- Inexperienced Driver Excess. The average excess amount is $400 for a driver towing the caravan who was over 25 but had only had a licence for two or fewer years.

- Underwriting Excess. This is determined at the start of a policy based on the driver’s claim’s history and experience.

Which Claims Will Require the Excess to be Paid?

With the exception that another driver was at fault and you can provide their details, there will always be some excess to pay on an insurance claim. Like any insurance coverage, it is a good idea to determine if making a claim is worth it. If the costs will be the same as the excess, you may want to reconsider. Claims that will require an excess to be paid include theft, fire damage, vandalism, an at-fault accident, windscreen or window glass damage, and an event where the accident was not your fault but you have no details of the other person.

What to Look Out For When Choosing a Policy

When shopping around for a caravan insurance policy, there is no one-size-fits-all solution, so look closely at the inclusions that are important to you. Here are a few important things to remember when choosing a policy.

- Have the correct type of cover. Ensure you have covered your caravan for being static if you are not moving anywhere, or touring if you are heading out on the road. If you sign up for static, but the incident happens on the road, you will not be covered.

- Insure the caravan for what it is worth. Caravan insurance companies will insure the van for ‘market value’ which is the price it is worth on the market at the time. That is all good unless you have done upgrades and increased the value of it with thousands of dollars worth of work. If so, insure it for an ‘agreed value’ that is more aligned with the true value rather than perceived. The value should be reassessed every 12 months.

- Be realistic about the contents. The standard cover for contents is $1000, which is rarely enough to cover everything in the caravan. Most insurers don’t include things like phones, laptops, and cameras in their cover, so make sure you read the policy and possibly request extra cover for certain items.

- Understand the limits of the insurance policy. All insurance providers have different limits to their coverage, so read the insurance policy carefully to understand these limits and if they will work for your needs. For instance, there could be limits on where the caravan would be towed to or how much the excess is for a young driver, which might force you to look elsewhere for a more suitable policy.

- Find out if you can get a discount if the caravan is stored for long periods. If you only take the caravan out occasionally, find out about lay-up cover from your insurer. You would pay a reduced premium for the times it is being stored and not used. It is imperative that you tell the insurer if you use it or you will not be covered.

How to Keep Your Insurance Premium Down

There are various ways to keep your insurance premium to a minimum by showing insurance providers you have taken precautionary measures to secure your caravan. Here are a few tips to lower your insurance premium.

- House the caravan in secure storage like a garage when it is not being used.

- Install alarm systems in the caravan.

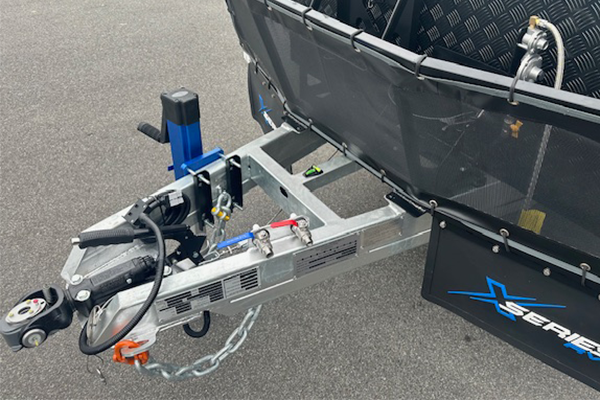

- Invest in wheel clamps, padlocks, chains, or hitch locks so no one can steal your caravan.

- Make sure you have a clean driving record and a spotless car insurance record.

- Purchase a safe for expensive items that will be stored in the caravan.

- Choose the higher excess to reduce your overall premium.

Whether heading off on a family holiday or hitting the open road for a never-ending adventure, there’s nothing better than the freedom you can experience in a caravan. The appropriate insurance coverage will give you peace of mind to let your hair down and enjoy every moment without fear of unforeseen incidents. To find the best insurance for your needs, consider key factors such as the type of coverage, the intended use of the caravan, the age and experience of the driver, the excess amount and the contents in the van. For expert advice, we recommend contacting an insurance provider.